Credit report and score in Australia can be complicated at times.

Credit repair Australia wide is becoming a much-needed tool for many Australians.

Your credit report and score determine your ability to obtain finance and there is more than one credit report in Australia for each of us.

We each have a credit report with Veda and Dun & Bradstreet (2 separate credit reporting bureaus) and there is also a large American firm called Experian entering our market.

There can be different information on each credit report.

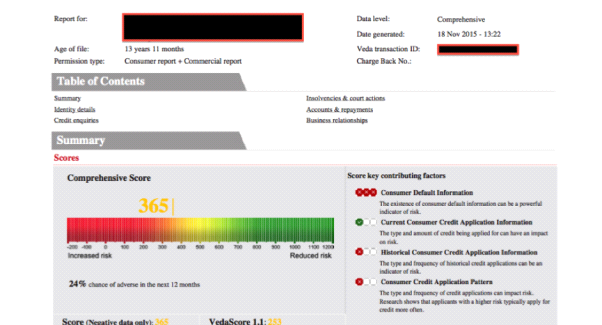

Veda offers a credit report with a score. This score ranges from 0 to 1200. The score is one section of your credit worthiness, the other part being the actual credit report.

Where you have applied for finance, or been late in payments, is all documented within the credit report, and then this affects the credit score.

Below is an example of a credit report and score:

The above score is not good, being 365. This could be due to an overdue payment (Default) or court action or other negative information within the report.

This individual could not obtain finance for his new home with this score. He had a Telco default that was preventing him from getting approved. His wife called out team, and we removed the Telco default.

The individual’s credit report and score immediately improved and the credit score increased to 758 and he was approved with the best interest rate loan for his new home within 4 weeks of fixing his credit.

At Credit Fix Solutions, we offer no win no fee credit repair Australia wide, and can help you understand the credit report and score, free of charge.

Call our Credit Repair Experts on 1300 43 65 69 or 02 8896 6256 and improve your credit report and score.